Maximize your business potential

We provide tailored financial solutions, delivered effectively. Working with our experienced team, you get big bank protection with community bank connection.

No matter where you are in the business lifecycle, mitigating risk through the development of efficient operations that will both protect what you’ve worked hard to build, and save time doing it, is a daily challenge. We measure partnerships successful with one metric — did we help you accomplish your goals? Working with our experienced team, we provide tailored financial knowledge, guidance, and solutions to see you across your journey. With us, you get big bank protection with community bank connection. - Elijah Mason, Treasury Management Officer

Digital and Payment Solutions

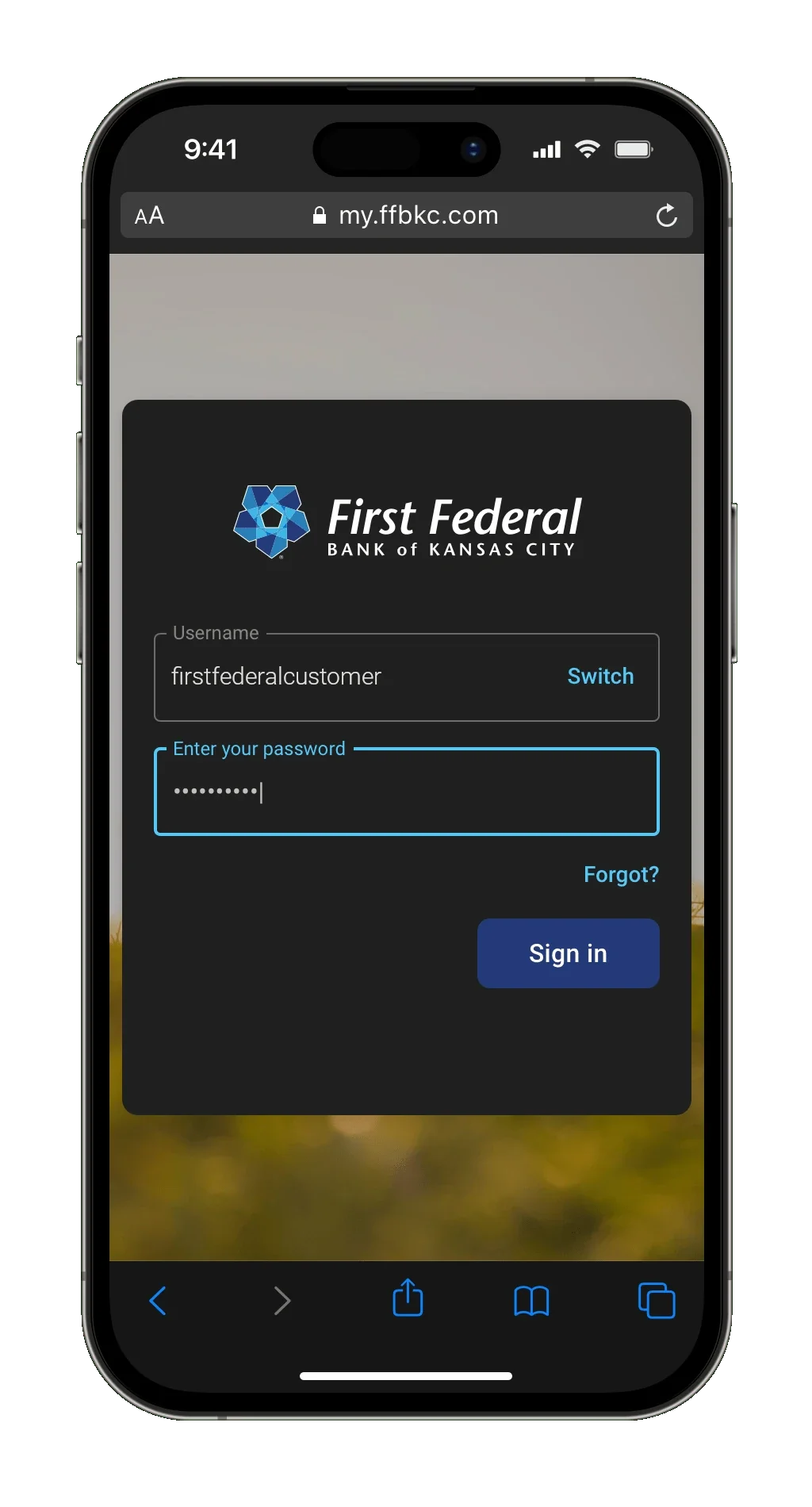

Streamline your business finances with powerful digital tools. Our digital services help you handle the complex financial demands of your business with confidence.

ACH Origination

Make fast, secure payments on-demand with ACH origination. ACH payments can be made anytime, anywhere, and can even help reduce fees.

Features:

- Direct Deposit

- Automated Payment Scheduling

- Real-Time Payment Tracking

- Data Encryption and Security

- Batch Processing

- Regulatory Compliance

Benefits:

- Improved Efficiency: Automates payment processing, reducing the time spent on manual tasks like check writing and delivery.

- Cost Savings: Reduces the need for paper checks, postage, and check printing, leading to direct cost savings for businesses.

- Faster Payments: Employees, vendors, and other recipients receive payments more quickly, often within 1-2 business days, enhancing cash flow and eliminating delays.

- Convenience: Payments can be made anytime, anywhere, without the need for physical checks.

- Security and Reliability: ACH is a secure and reliable payment method, with built-in encryption and fraud prevention measures

Learn how to get started with ACH Origination in digital banking.

Positive Pay

Protect your business with Check & ACH Positive Pay. This powerful tool stops unauthorized payments in their tracks, giving businesses peace of mind and the upper hand in the fight against Fraud.

Features:

- Check Matching System

- ACH Positive Pay (ACH Filter/Block)

- Exception Reporting

- Real-Time Alerts & Online Review

- Batch Upload Capability

- Daily Reconciliation Support

- Audit Trail & Reporting

- User Permission Controls

Benefits:

- Peace of Mind: Know that every check and ACH payment is verified before money leaves the account.

- Protection from Fraud: Stop altered, counterfeit, or unauthorized transactions before they become losses.

- Build Trust with Vendors and Employees: Payments are secure and consistent, enhancing your reputation for professionalism and reliability.

- Strengthen Internal Control: Adds a layer of accountability and oversight to your payment process.

Learn how to get started with Positive Pay in digital banking.

Remote Deposit Capture

Deposit checks securely from your office or even on the go—saving you time and eliminating trips to the bank. With funds typically available within one business day, you can improve your cash flow and keep your business moving.

Features:

- Check Scanning: Captures high-quality images of checks using a scanner or mobile device.

- Encryption & Security: Ensures secure data transmission with encryption and SSL protocols.

- Web/Mobile Interface: User-friendly platforms for uploading, tracking, and managing deposits.

- Check Validation: Automatic validation of check amounts.

- Error Detection: Automatically detects image quality issues and duplicates.

- Compliance: Adheres to regulations like the Check 21 Act and PCI-DSS for secure transactions.

Benefits:

- Improved Cash Flow: RDC speeds up check processing, providing faster access to funds.

- Time Savings: Eliminates trips to the bank, allowing businesses to focus on other tasks.

- Convenience: Deposits can be made 24/7 from any location.

- Security: Check images are encrypted, reducing fraud and loss risks.

- Cost Savings: Reduces travel, administrative costs, and human error.

User and Account Tools

Internal Transfers

- Simplify your cash management with powerful transfer tools. Easily transfer funds between your accounts to pay bills,or organize funds with confidence.

- Learn how to set up transfers in digital banking for businesses.

Bill Pay

- Send one-time payments or schedule recurring bill payments online.

- Learn how to pay bills in digital banking for businesses.

User Management

- Digital banking for businesses offers granular control over user access to your accounts, ensuring precise management of permissions. Safeguard your operations with dual administrators and up to triple user-approval when processing payments.

- Learn how to manage users in digital banking for business.

Merchant Services

Expand your customers’ payment options. Our Merchant Services let you accept credit cards, debit cards, and digital wallets so you can streamline sales and meet modern payment expectations.

Improve Cash flow. Since card payments typically settle quicker than cash or checks, enjoy faster access to funds, reduce cash flow concerns and enable timely payments.

Increase convenience for customers. Payments are quick, whether through cards, mobile wallets, or online, creating a smooth checkout experience for your customers.

Build customer loyalty. Create loyalty programs to keep customers coming back.

Financial Control & Insights. Track sales, customer preferences, and transaction history in real-time with robust reporting tools.

Enhance Customer Trust & Security. Advanced fraud protection, encryption, and PCI compliance give customers confidence that their payment information is safe.

Liquidity Management

Optimize your cash flow with enhanced financial decision-making for your operations and investments. Our team of professionals is here to help you turn financial insight into lasting impact.

Sweep Accounts

Gain efficiency and peace of mind with a sweep account. Automate transfers of funds to maximize earnings or reduce expenses.

*Line of Credit Sweeps available for sweep services

- Automate Cash Management: Reduce manual transfers and improve your efficiency

- Maximize Interest: Your excess cash earns interest instead of sitting idle

- Prevent Overdrafts: Ensure your funds are available when needed

Target Balance Accounts

Minimize risk by sweeping funds in or out of an account. Keeps your cash central instead of spread throughout multiple accounts.

- Target Balance Accounts (TBAs) set a target balance for sweeping funds in or out of an account. In a Zero Balance Account (ZBA), the target is set to zero.

- Minimize risk by ensuring cash is never idle.

- Get visibility and control over cash without micromanaging every day

- Includes overdraft protection

ICS

Insured Cash Sweep (ICS) service allows customers to access multi-million-dollar FDIC protection on large deposits, earn a return, and enjoy flexibility.

- Preserve full FDIC insurance on deposits over $250,000 as excess funds are distributed across a trusted network of banks*.

- Keep your funds accessible, with the liquidity of a traditional account.

- Choose the account that fits your needs—First Federal offers multiple account options eligible for ICS. Learn more about ICS

CDARS

By leveraging CDARS®, you can access multi-million-dollar FDIC insurance on CD investments.

- Access multi-million-dollar FDIC insurance on large deposits by placing funds into CDs issued across a network of participating banks.

- Enjoy the security of a fixed rate and the simplicity of working with just one bank and one statement.

- Choose the CD term that aligns with your goals—First Federal offers flexible options through CDARS. Learn more about CDARS

*A list identifying IntraFi network banks can be found at www.intrafi.com/network-banks. Certain conditions must be satisfied for “pass-through” FDIC deposit insurance coverage to apply.

Account Analysis

Keeping track of fees and charges can get complicated. Enhanced Account Analysis can provide a clear, consolidated view of all your banking activities and balances, so you’ll see exactly what you’re paying for each service and manage costs more effectively.

Get a clear picture of your account activity

Analyzed accounts is a service that can be added to any of our business accounts.

Features and benefits:

- Use an earnings credit based on the account balance, to offset banking fees

- Breaks down costs by service, so you feel in control not in the dark

- Get one consolidated, clear statement that includes:

- Balances across multiple business accounts

- Service charges (e.g., wire transfers, ACH, check processing)

- Earnings credit allowance (ECR) – an offset to service fees based on balances

- Fees waived vs. fees charged

- Account activity metrics (volume of transactions, cash handling, etc.)

- Clarity and control – No more mystery around bank fees

- Aggregates data across multiple business accounts, empowering you to make smart financial decisions

- Helps identify high-cost services or inefficiencies and make informed decisions about banking structure or cash management

Along with analyzed accounts, our accounts include a robust digital banking interface, which integrates seamlessly with tools like QuickBooks, and Autobooks, giving you complete control and clear insight into your financial activities.

Get in touch to set up the banking solutions your business needs to thrive.

View our Business Fee Schedule