What’s the best way to pay off debt?

Debt can help us accomplish goals, like getting a loan for a car or making some upgrades at home, but it’s easy to fall behind if you take on more debt than you can afford to pay back. Experian's Q2 2023 Consumer Credit Review reports the average non-mortgage debt balance is more than $23,000. With credit card interest rates averaging 22% according to the Federal Reserve, it’s important to keep an eye on your balance and make monthly payments before there’s a mountain of unpaid interest in front of you. The good news is that you can regain control and pay down your debts by following one of these three payoff strategies.

GROW your money with a high-yield savings account

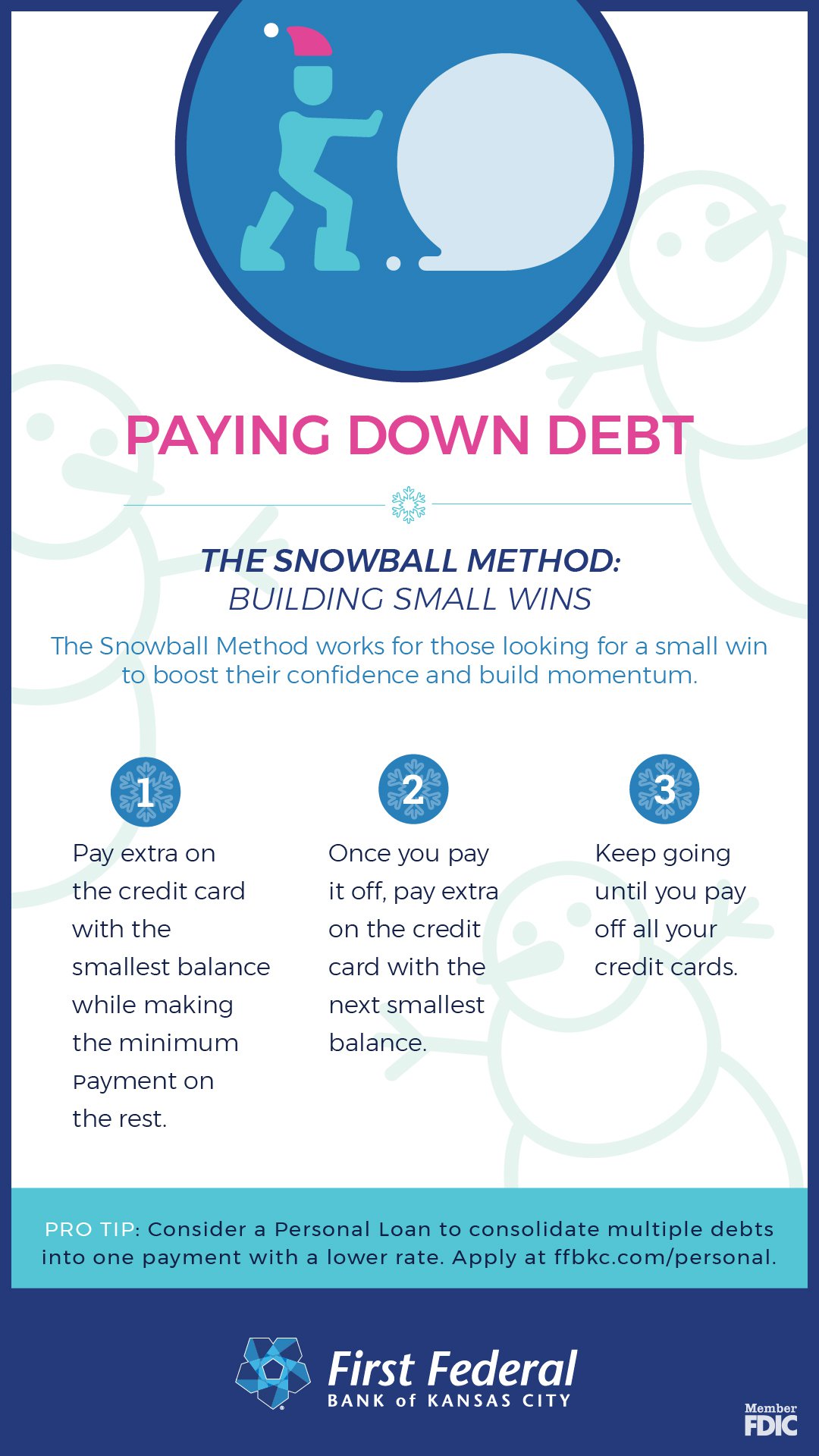

The Snowball Method

Using the snowball method, you’ll target the account with the smallest balance first while continuing to make the minimum payment on all others. Once the first is paid off, take the money you were paying on the smallest balance and instead, put it toward your next smallest until it’s paid off, too. Starting with the lowest balance will show progress quickly and help you build momentum to go after the higher balances.

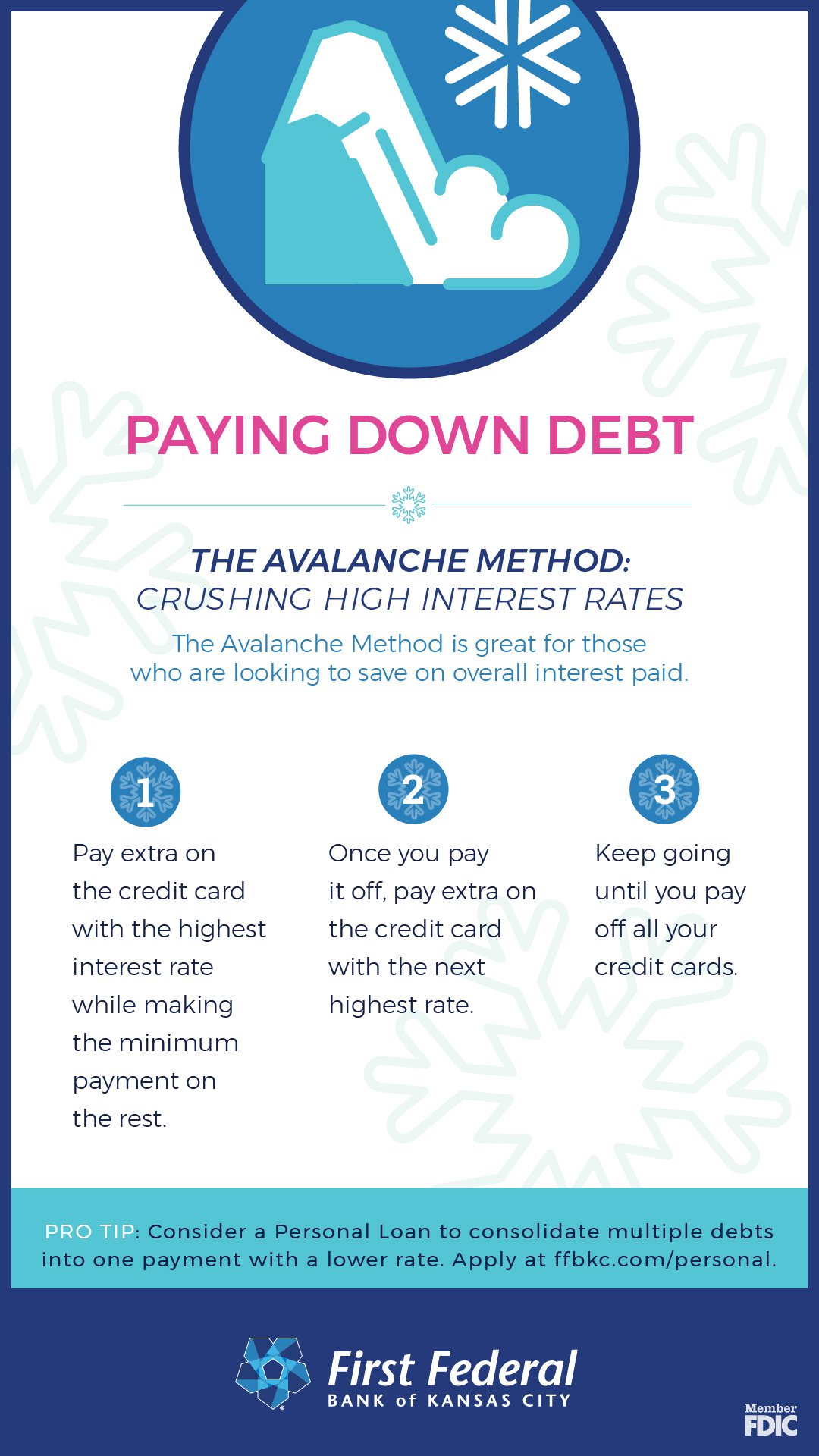

The Avalanche Method

To follow the avalanche method, list out your debts by interest rate from highest to lowest. Start by paying extra on the account with the highest rate until it’s paid off, and then contribute those funds to the account with the next highest rate, so on and so forth.This method is efficient and helps you save on total interest payments in the long-term.

Debt Consolidation

Another option is to consolidate your debt into one loan and ideally, secure more favorable terms than the credit card companies could offer. This method works well to reset your focus on just one loan if paying on multiple accounts feels stressful. Plus, if you’re saving on interest payments, you can use the extra funds to pay more than the minimum to pay off the loan faster.

Taking out loans or paying on credit cards can be helpful for larger purchases, but multiple accounts and high interest rates may make it difficult to keep up with payments. Take time to develop a debt payoff strategy from the very beginning that works for your budget and goals. Remember, it’s your financial future to control!